The pandemic and its aftermath have vindicated the economic performance of both presidents. The COVID-19 crisis has transformed the job market, leading to rising inflation and increasing the federal debt by trillions of dollars.

45th US President Donald Trump and 46th US President Joe Biden. Photo: AFP

The US economy today is very different from when Trump took office in 2017. Every administration leaves its mark. Mr. Biden has reduced student debt by billions of dollars, creating 14 million more jobs in less than three years. Meanwhile, Mr. Trump has promoted inflation, reduced interest rates and reduced gas prices. These are specific comparisons.

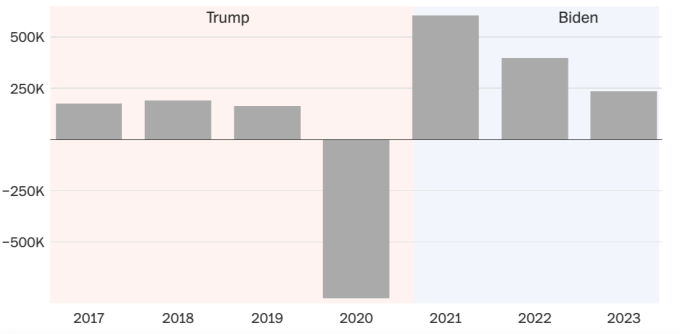

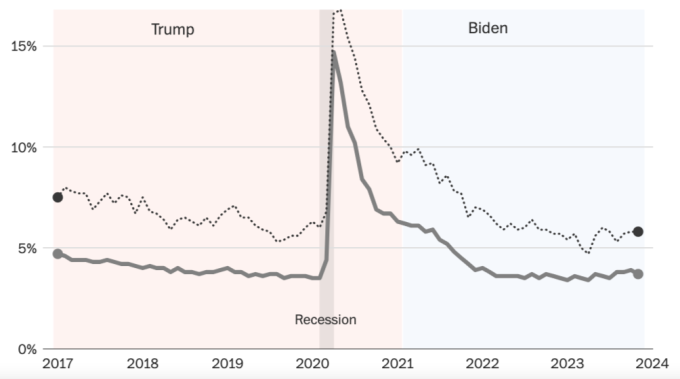

Employment status

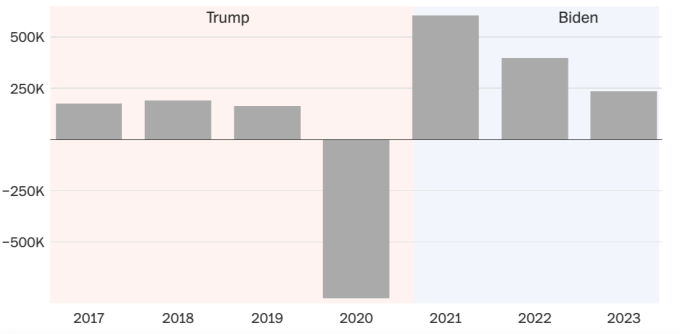

The biggest victory the White House achieved was a strong labor market. This is partly because Biden took office at a time when the pandemic caused millions of people to lose their jobs. However, the pace of job growth in recent years has far exceeded experts' predictions and fueled outstanding economic growth.

Despite the US Federal Reserve (Fed) raising interest rates, the labor market remains healthy. When Americans have jobs, they can fight inflation, continue to spend, and support the economy.

Average number of jobs created each month. Graphics: Washington Post

During the Biden era, employers created more than 400,000 positions per month, creating 14 million jobs. Before the shutdowns and layoffs caused by COVID-19, the economy created an average of 176,000 jobs per month during Trump's first three years.

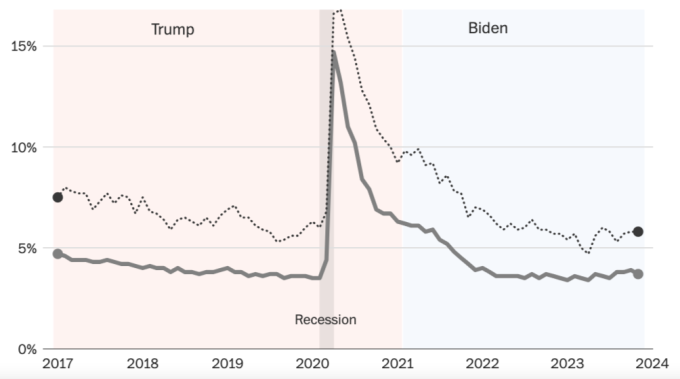

Aside from increases due to COVID-19 throughout much of 2020 and 2021, unemployment has been low during both the Trump and Biden presidencies. Unemployment under Trump fell to a half-century low of 3.5% in early 2020 just before the pandemic. It decreased even further during Biden's term; earlier this year, it dropped to 3.4% and is now at 3.7%.

Overall unemployment rate (solid line) and that of people of color (dashed line). Graphics: Washington Post

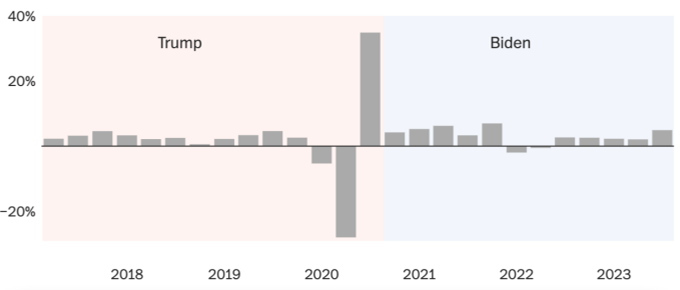

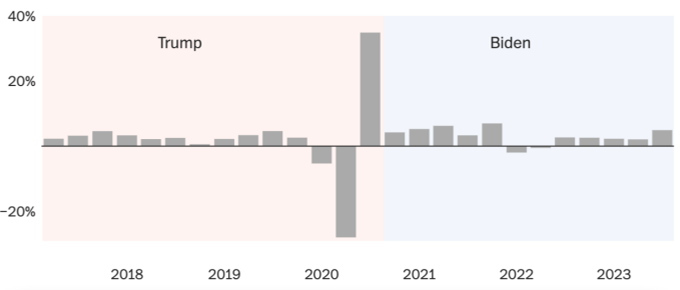

Financial growth

Under Trump and Biden, the US economy grew steadily. As the pandemic forced the economy into a sharp and sudden recession, GDP has grown about 22% since Biden took office, compared with 14% during Trump's term. Then the economy recovered quickly, thanks in part to trillions of dollars in stimulus money, growing again shortly after Trump left the White House.

US GDP growth, seasonally adjusted and constant USD prices in 2017. Graphic: Washington Post

After six months of contraction last year, the economy has grown for five straight quarters under Biden. Massive consumer spending and green energy and infrastructure projects support the expansion, which accounts for about 70% of the economy. However, economists predict the current growth rate is unsustainable and predict that it will slow down next year.

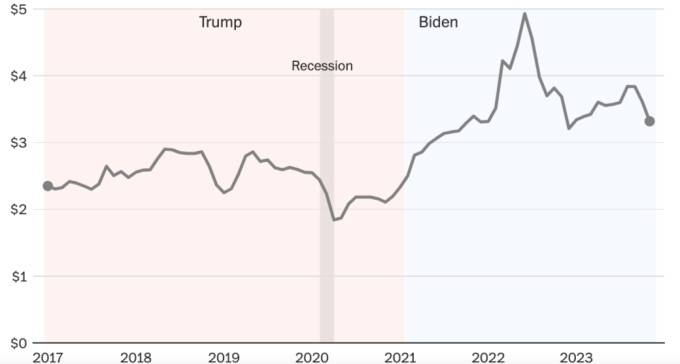

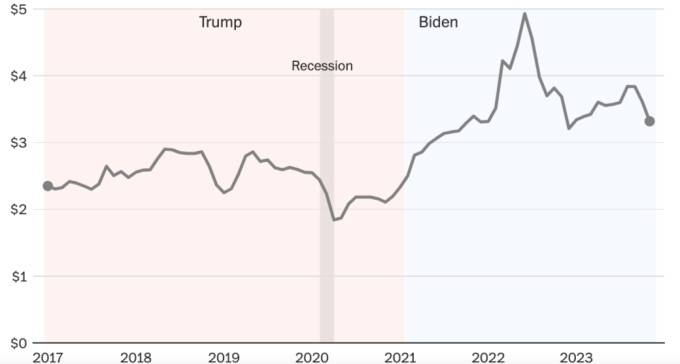

Gasoline selling price

The President of the United States has very little power to regulate gas prices. However, the Trump era has brought greater benefits to Americans in this regard. Since 2020, gas prices have increased sharply due to the pandemic, the war in Ukraine and a spike in demand. Gasoline prices doubled from April 2020 to April 2022, increasing from $1.84 per gallon (3.78 liters) to $4.11 per gallon.)

National average gasoline price (USD). Graphics: Washington Post

Gasoline prices in the United States peaked at nearly $5 a gallon in June 2022, but have since dropped. Analysts predict that as gasoline production increases and demand slows later this year, gasoline prices could fall below $3 per gallon. Americans' opinions about the economy are directly affected by gas prices. For much of President Biden's term, uncertainty has increased gas prices.

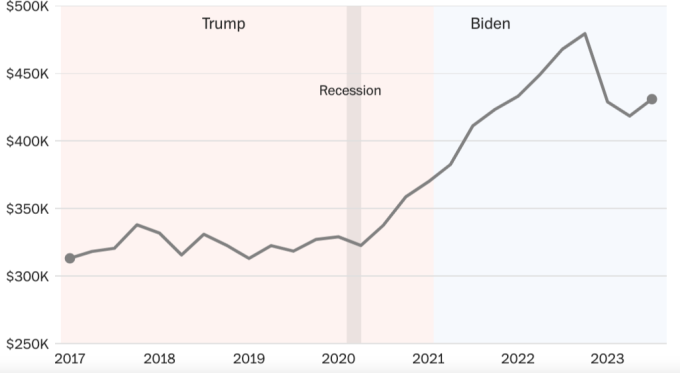

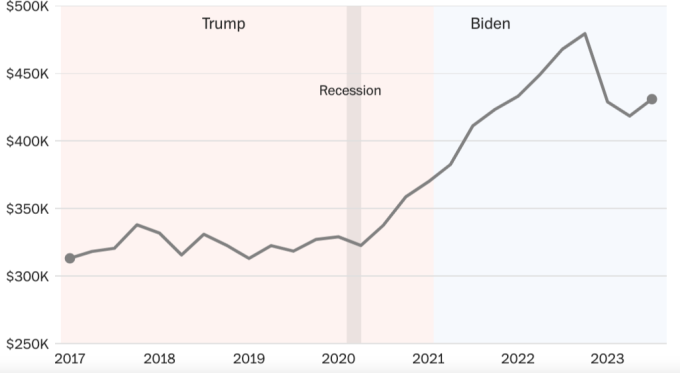

House selling price

One of the best ways for Americans to get rich is to own a home. Rising house prices are a double-edged sword. Although large numbers of first home buyers have been priced out of the market, those who already own property have benefited from its increase in value.

National average house price (thousand USD). Graphics: Washington Post

Overall, under Biden, homeownership has become much more difficult. According to Goldman Sachs, home prices have skyrocketed 49% from spring 2020 to fall 2022. Housing affordability has dropped to its lowest level in history due to rising costs.

Before the pandemic, the average home price was $431,000 per unit. Over the past two years, home loan interest rates have more than doubled, rising from about 3.1% to about 7%. But demand exceeds supply, causing house prices to remain high.

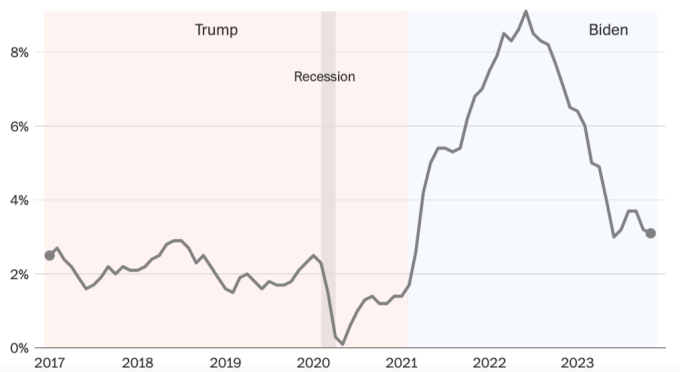

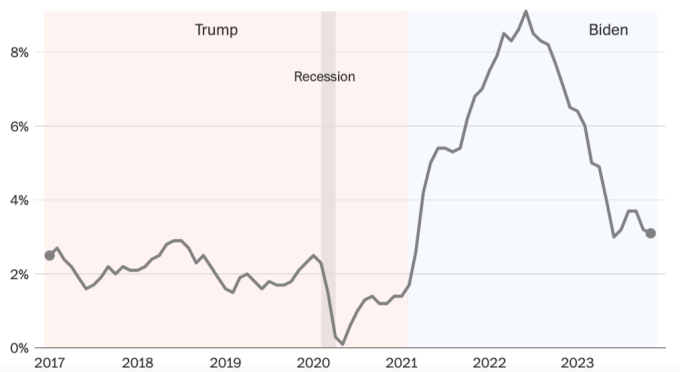

Inflationary

The Biden administration is facing inflation for a long time. After the pandemic, prices rose rapidly, leading to the highest inflation in more than forty years. Almost everything, from groceries to gasoline to cars to health care, has increased costs for Americans.

Developments in the consumer price index (CPI). Graphics: Washington Post

Prices remain about 3% higher than a year ago even though inflation has recently eased from its peak last summer. Inflation is consistently cited by voters as their main economic concern.

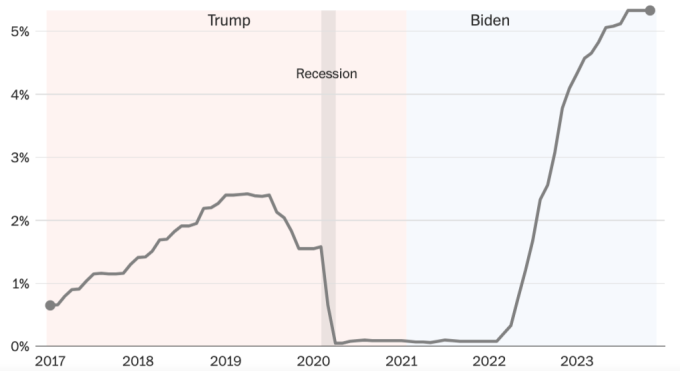

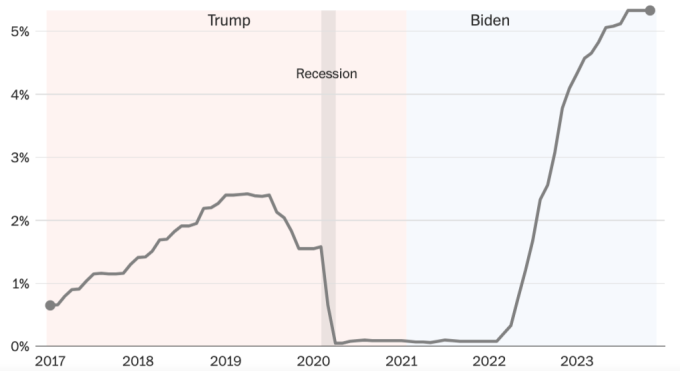

Interest rate

Because the Federal Reserve operates independently, the president of the United States has little control over interest rates. To rein in inflation, the Federal Reserve raised interest rates 11 times during Biden's term. This brought the base interest rate to 5.25 to 5.5%, the highest level in the past 22 years.

Basic interest rate developments. Graphics: Washington Post

Every time the Federal Reserve raises interest rates, or even just hints at one, it ripples through the economy, leading to higher interest rates on loan types like mortgages (currently around 7%). , personal loans (12%) and credit cards (currently at

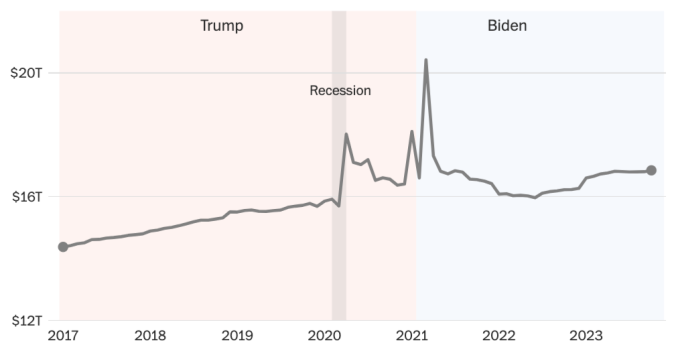

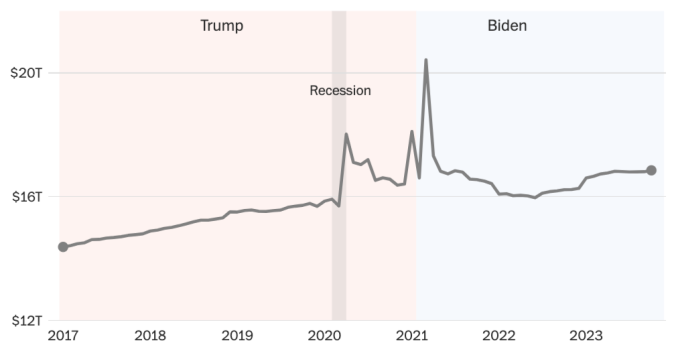

Real income

Americans' disposable income—the real income left over after taxes and inflation—increased steadily in the Trump years until the pandemic struck. It increased about 10% from January 2017 to January 2020.

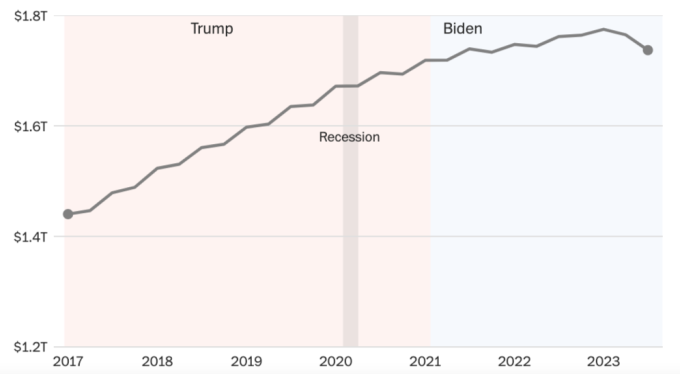

Total disposable income of US households (trillion USD). Graphics: Washington Post

However, during Biden's term, reduced stimulus payments and rising prices have significantly impacted household income since 2020. However, due to wage increases above inflation, many Americans are closing 2023 will be better off than last year.

Stock market

The stock market rose rapidly during Trump's term and continues to rise under Biden. Share prices have rebounded after last year's slowdown on expectations of higher borrowing costs and increased volatility. Investors are optimistic that the Fed has ended its monetary tightening cycle. This month, the Dow Jones and Nasdaq both hit historic highs, and the S&P 500 is also continuing to rise.

Dow Jones index developments. Graphics: Washington Post

Throughout his term, Trump often used social networks to show off his achievements, and always closely monitored stock market developments. He claimed that a Biden presidency would lead to a "stock market crash" like never before. Do not have. "Very good, Donald," Mr. Biden said on X recently.

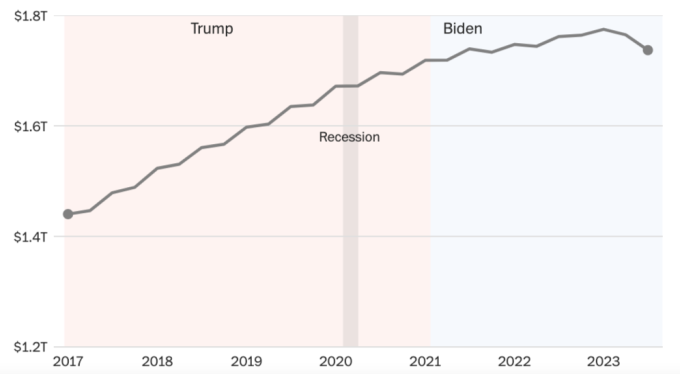

Student debt

Over the past nearly twenty years, student loan debt has increased. Biden pledged to reduce the student debt burden when he took office. However, the Supreme Court and Republican lawmakers blocked the ambitious plan that included $400 billion in debt forgiveness. He found other methods of support.

Total outstanding student loan debt (trillion USD). Graphics: Washington Post

To date, the White House has resolved the student loan debt of more than 3.6 million individuals for $132 billion. Additionally, they have increased grants for middle- and lower-income students. Student loan debt has fallen in six months, to $1,740 billion in October from a record $1,770 billion at the beginning of the year.

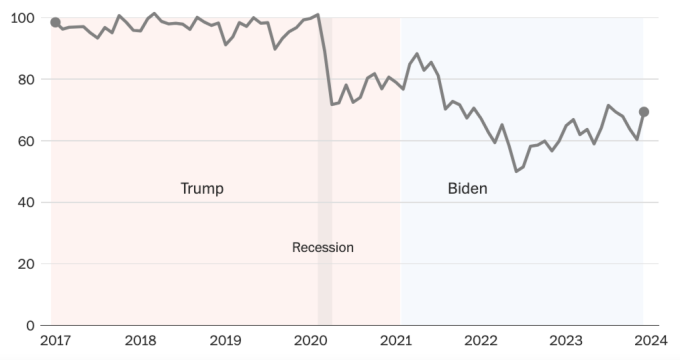

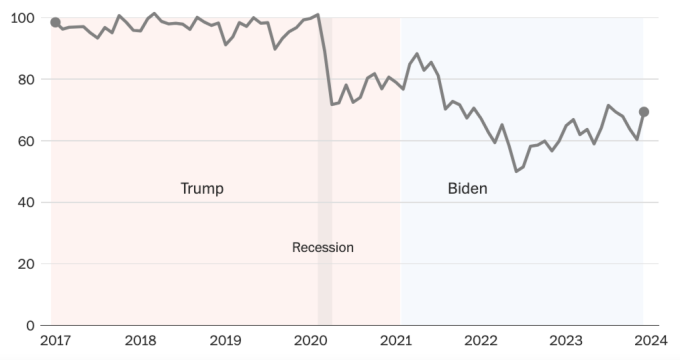

Consumer psychology

During Biden's term, Americans still appear discouraged when it comes to personal finances. This comes despite the economy being strong. In June 2022, gas prices peaked, consumer sentiment dropped to a record low. Since then, Trump's sentiment has recovered a bit, but it is still lower than when he was president.

Evolution of American consumer psychology. Graphics: Washington Post

Americans are still spending heavily even though the economy is weakening. Spending on many goods and services, such as cars, travel and outdoor dining, boosted the economy.

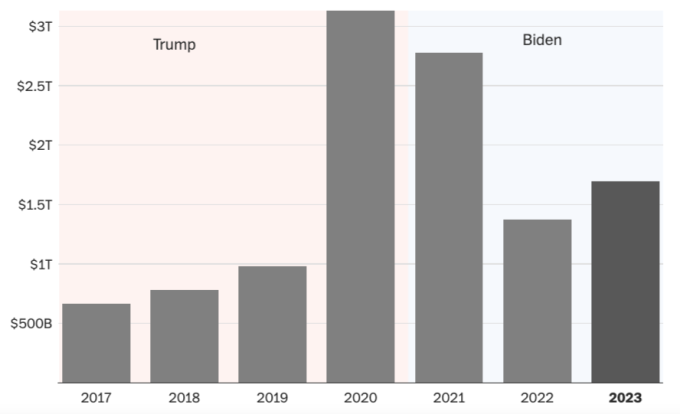

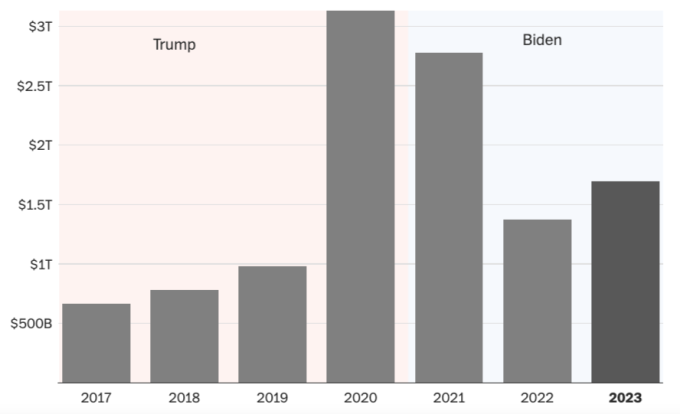

National deficit

Although both Trump and Biden have added trillions of dollars to the national debt, the federal deficit, which is the difference between how much the government takes in and spends, has peaked under Trump. Throughout President Trump's term, the deficit has increased every year. The government responded to the pandemic with sweeping tax cuts, increasing the debt by $7.8 trillion.

US federal deficit by year (trillion USD). Graphics: Washington Post

The deficit has since fallen in Biden's first two years in office. However, this year it increased 23 percent to $1,700 billion. Rating agencies are sounding the alarm due to the growing deficit combined with political turmoil in Congress. In August, America's AAA score was stripped by Fitch Ratings. In November, Moody's warned of "continued political polarization" that threatened the nation's fiscal health.

Washington Post